Did you know 87% of homes built before 1940 have lead paint? It’s vital to know how to remove paint from wood safely. Removing paint can be tough, but with the right tools and methods, it’s achievable. Whether you’re fixing furniture or getting ready for new paint, there are many ways to do it.

Paint strippers are often better than sanding, which is great for curved and tight spots. Many strippers have little smell and are easy to clean up with water. It’s important to pick the right method for your project, considering the paint and wood types, and what you want to achieve.

Knowing how to remove paint from wood is a useful skill for DIY fans and homeowners. With the right tools and techniques, you can get professional results safely. This article will cover different paint removal methods, like chemical strippers, heat guns, and sanding. We’ll help you find the best way for your project and show you how to do it right.

Key Takeaways

- Removing paint from wood can be a challenging task, but with the right techniques and tools, it can be done easily and effectively.

- Using paint strippers is often easier and more effective than sanding, even on curved and tight spots.

- Many paint stripper brands have minimal fumes and odor, with some designed for easy clean-up with water.

- Choosing the right method for your project is key, considering the paint and wood types, and your goals.

- Learning how to remove paint from wood is a valuable skill for any DIY enthusiast or homeowner.

- Chemical paint strippers, heat guns, and sanding are popular methods for stripping paint from wood and removing paint from wood.

Understanding Different Types of Paint on Wood

Removing paint from wood starts with knowing the paint type. You’ll find oil-based and latex paint, each needing a specific method. To remove paint well, figuring out the paint type is key. Many tutorials on world on youtube show how to strip paint from wood, thanks to users uploading original content.

Oil-based paint is tougher to remove than latex. It’s often on hardwood floors and needs a solvent stripper. Latex paint, being water-based, can be stripped with a water-based solution. So, picking the right stripper is vital for removing paint from wood.

Here are some key differences between oil-based and latex paint:

- Oil-based paint: more durable, but harder to remove

- Latex paint: easier to remove, but less durable

Knowing these differences helps you remove paint effectively from wood. This ensures your project turns out right.

Understanding your wood’s paint type lets you pick the best removal method. Whether it’s a floor or furniture, removing paint is tough. But with the right tools and knowledge, you can get professional results.

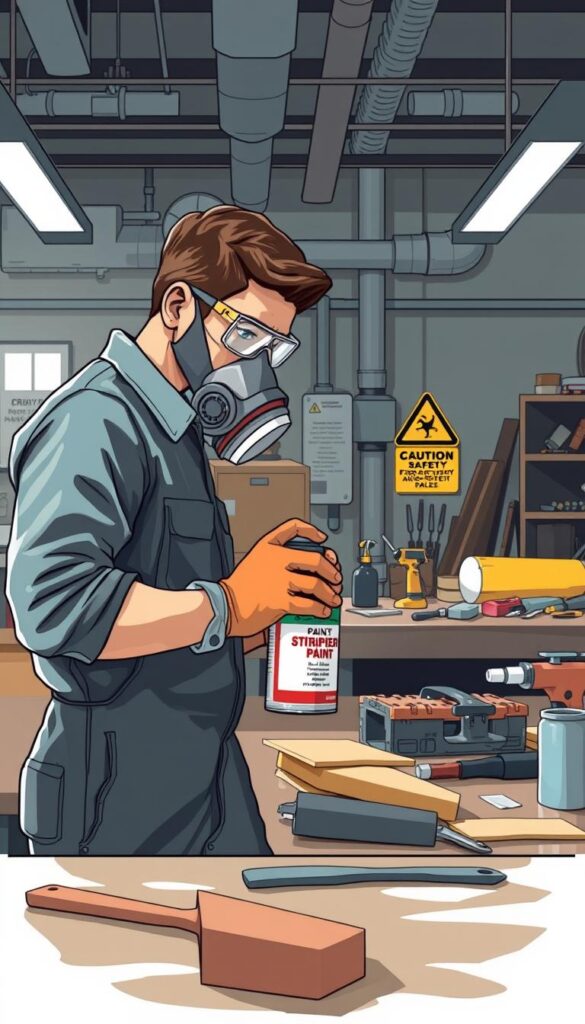

Essential Safety Precautions for Paint Removal

Removing paint from wood requires top safety priority. Using paint remover or trying to remove paint without safety can harm health and damage wood. Wood stripping is risky, so it’s key to take safety steps to avoid injury and wood damage.

Working in a well-ventilated area, away from sunlight and heat, is critical. This prevents toxic fumes and fire risks. Always wear protective gear like gloves, safety glasses, and a mask when using chemical strippers. Use both manual and power tools safely to avoid wood damage.

Removing paint and varnish from wood is tough, but safety makes it possible. Choose the right paint remover and follow the instructions carefully. Important safety tips include:

- Wearing protective gear, including gloves, safety glasses, and a mask

- Working in a well-ventilated area, away from direct sunlight and heat sources

- Using a combination of manual stripping tools and power tools to avoid damaging the wood

- Following the manufacturer’s instructions when using chemical paint strippers

By following these safety steps, you can safely remove paint without harming the wood or yourself. Always put safety first when using paint removers and wood tools. Never skip on quality protective gear.

Required Tools and Materials for Wood Paint Removal

Removing old paint from wood needs the right tools and materials. This includes manual and power tools, and chemical strippers. Chemical paint strippers can take off many layers of paint, making them a top choice.

PeelAway 1 and PeelAway 7 are popular chemical paint strippers. PeelAway 1 works well on paints from the 1970s and earlier. PeelAway 7 is better for modern paints. These products can remove varnish and come in sizes from 250ml to 500ml.

When using chemical paint strippers, follow the instructions carefully. Wear protective gear like gloves and a mask. Work in a well-ventilated area. Test the product on a small area first to avoid damaging the wood. Based paint can be tough to remove, but the right tools and materials can help.

Other tools and materials needed include manual stripping tools and power tools. Tools like scrapers, sandpaper, heat guns, and infrared devices help remove paint and varnish. They prepare the wood for new paint or finish. Using the right tools and materials can restore your wood surfaces to their original beauty.

| Product | Size | Price |

|---|---|---|

| PeelAway 1 | 1¼ gallons | $45 |

| PeelAway 7 | 1¼ gallons | $50 |

| Citristrip | half gallon | $20 |

How to Remove Paint from Wood: Step-by-Step Guide

Removing paint from wood can be tough in home improvement projects. To soften the paint, use a solvent like CitriStrip Stripping Gel. It has no harsh fumes. Apply it to the paint and wait about 30 minutes to remove all the paint.

For latex paint, use a special paint stripper. Always follow the instructions and wear gloves. Make sure you work in a well-ventilated area. Choosing the right tools is key for woodworking projects.

Here are some steps to follow:

- Apply the paint stripper to the wood surface

- Let it sit for the recommended time

- Scrape off the paint using a putty knife or steel wool

- Sand the surface to smooth out any rough areas

Always test the paint stripper on a small area first. This ensures it won’t harm the wood. With the right tools and techniques, you can get the paint off and get a beautiful finish for your home improvement project.

Chemical Stripping Methods and Techniques

Chemical stripping is a common way to remove paint from wood. It’s great for detailed moldings because it’s precise. First, pick the right paint stripper. Think about the paint type, surface, and how much stripping you need.

Some strippers, like methylene chloride, work fast. Others, like green alternatives, take longer. For example, CitriStrip needs a second treatment for thick paint layers. The time it takes to work varies, depending on the product and paint layers.

Apply the stripper as directed, usually about 1/8 inch thick. Always wear proper protective gear to avoid chemical exposure. Wait the recommended time, often 15 minutes, before scraping off the paint. For thick paint, you might need to apply it more than once.

To clean wood pores, use steel wool (000 grade). It’s also important to neutralize the stripper to prevent paint failure. Using elbow grease and paint thinner can help with dried paint, like on hardwood.

Some strippers, like TotalBoat TotalStrip, can be applied thicker and work faster. But always follow the instructions and safety guidelines. With the right methods, you can remove paint and reveal your wood’s original beauty. Sometimes, a heat gun is needed for tough paint.

- Choose the right paint stripper for your specific needs

- Apply the stripper at the recommended thickness and wait the recommended time

- Use proper PPE to avoid exposure to harsh chemicals

- Neutralize the stripper after use to prevent paint failure

- Consider using elbow grease and paint thinner to remove dried paint

By following these steps and using the right techniques, you can get professional results. This will help you restore your wood surface to its original beauty, no matter the surface type.

Heat-Based Paint Removal Approaches

Heat-based methods can be great for removing water based paint from wood. They use a heat gun or other heat source to soften the paint. This makes it easier to remove. Always work in a well-ventilated area to avoid inhaling fumes.

To remove the paint without damaging the wood, you need the right tools and techniques. A heat gun softens the paint. Then, use a scraper or sandpaper with a coarse grit to remove it. For delicate surfaces like hardwood, use a finer grit.

Heat-based methods can remove multiple layers of paint at once. But, be careful not to apply too much heat, which can damage the wood. By using the right techniques and tools, you can safely remove paint off the hardwood using heat.

Mechanical Paint Removal Techniques

Removing old paint from wood can be done with mechanical methods. These are good for small areas or when chemical strippers don’t work. But, there’s a risk of paint bubbles or harming the wood underneath. It’s key to use the right tools and techniques to avoid this.

Removing old paint can be tough, like when there are many layers or caustic substances. But, with the right approach, you can get a smooth finish without damaging the wood. It’s important to work in a well-ventilated area because of the fume from chemical strippers.

Some common mechanical paint removal techniques include:

- Sanding: Using a sanding block or power sander to remove paint

- Scraping: Using a scraper or putty knife to remove paint

- Using power tools: Such as a drill or rotary tool with a sanding attachment

When using these techniques, it’s important to be gentle. This way, you avoid chipping the wood. Even though paint may come off quickly, it’s vital to work carefully to not damage the surface.

In summary, mechanical paint removal techniques can be effective for removing old paint from wood. But, it’s important to use the right tools and techniques to avoid damaging the surface. By working carefully and using the right methods, you can get a smooth finish and prepare the wood for new paint or varnish.

| Technique | Tools Needed | Benefits |

|---|---|---|

| Sanding | Sanding block, power sander | Smooth finish, easy to use |

| Scraping | Scraper, putty knife | Effective for small areas, easy to control |

| Using power tools | Drill, rotary tool with sanding attachment | Fast, efficient, and effective for large areas |

Eco-Friendly Paint Removal Solutions

Many people want to remove paint from wood in a way that’s good for the planet and their health. Denatured alcohol is a chemical that works well for this. It removes paint without using harsh chemicals. Dry ice is another option, blasting paint away without chemicals.

It’s key to ventilate the area well when removing paint. This helps avoid breathing in harmful fumes.

Some eco-friendly paint removal solutions are perfect for big projects. For example, a chloride-based solution can remove paint from large areas without harming the wood underneath. Always follow the instructions carefully and take precautions to avoid accidents. If you see a drip or any issue, fix it right away to prevent more damage.

- Safe for the environment and your health

- Effective at removing paint without harsh chemicals

- Can be used on large surfaces

- Non-toxic and biodegradable

These eco-friendly solutions are also easy to use and clean up. They’re a great choice for anyone wanting to remove paint from wood safely. By picking an eco-friendly option, you help the planet and make a healthier space.

Dealing with Stubborn Paint and Special Situations

When facing stubborn paint, it’s key to always test different removal methods. A wire brush works well for painted white surfaces to gently scrape off loose paint. But for tougher spots, a putty knife or an orbital sander might be needed.

Applying a dab of paint remover to a small area can help test its effectiveness. Always follow the manufacturer’s instructions and take safety precautions when using chemical paint removers. For really tough jobs, an orbital sander can strip away multiple layers of paint.

At times, you might need to mix tools and techniques to remove stubborn paint. Start with a wire brush to loosen the paint, then use a putty knife to scrape it off. Finish with an orbital sander to smooth the surface. Being patient and trying different methods can help you remove stubborn paint and get a smooth finish.

Preserving Wood Quality During Paint Removal

When you remove paint from wood, keeping the wood quality is key. This ensures the surface stays intact and free from damage. Using a heat gun and scraper can work well, but you must be careful not to harm the wood. It’s also important to have good ventilation to avoid vapor buildup and keep the area safe.

A cotton ball can help apply a water-based paint remover safely. Using a paintbrush to apply the remover can also protect the wood. By following these steps, you can keep the wood quality high and get a smooth finish.

To further protect the wood, consider these tips:

* Choose a gentle paint remover that won’t harm the wood grain

* Work in a well-ventilated area to prevent vapor buildup

* Apply the remover with a paintbrush, not a roller or spray

* Avoid using too much heat, as it can damage the wood or change its color

Post-Removal Wood Treatment and Care

After removing paint from wood, it’s key to treat and care for the wood. This helps keep it healthy and strong. You can use a previous owner‘s method, but a plastic bag isn’t environmentally friendly. Instead, try a natural wood finish and apply it with a scrapper or soft cloth.

When working with wood, always wear goggles. Also, use acetone in a place with good air flow. This prevents harmful fumes from being inhaled. Here are some tips for taking care of your wood after removal:

- Apply a natural wood finish to protect the wood surface.

- Use a soft cloth or a scrapper to apply the finish.

- Avoid using plastic bags or other non-environmentally friendly materials.

- Wear goggles and work in a well-ventilated area when using acetone or other chemicals.

By following these tips, your wood will stay healthy and look great. You’ll enjoy your wood for many years.

Can Dry Erase Board Cleaning Methods Be Used to Remove Paint from Wood?

Removing paint from wood requires stronger solvents or sanding, as dry erase board cleaning methods are designed for marker stains, not paint. Gentle approaches like soapy water may work for minor spots, but tougher stains need specialized removers. Also Read: How to Easily Clean a Dry Erase Board for maintaining marker surfaces.

Conclusion

Removing paint from wood is a detailed task, but it’s very rewarding. By using the methods from this article, you can make old, painted wood look new again. This adds warmth and character to your home.

From wood paint removal to paint stripping wood, you now have the knowledge to remove tough paint layers. This knowledge helps you tackle any paint job with confidence.

Whether you’re doing it yourself or getting help from a pro, the right tools and methods are key. With care and patience, you can keep the wood safe and get a smooth finish. This finish will last for many years.

FAQ

How do I identify the type of paint on my wood surface?

Knowing the paint type on your wood is key for removal. Oil-based paint looks glossy and smells strong. Latex paint is matte and water-based.

What safety precautions should I take when removing paint from wood?

Paint removal from wood is risky. Always wear protective gear and work in a well-ventilated area. Dispose of waste properly.

What tools and materials do I need for wood paint removal?

The right tools and materials are essential. You’ll need manual tools like scrapers and power tools like orbital sanders. Chemical strippers are also important.

What is the step-by-step process for removing paint from wood?

Removing paint involves preparing the surface and applying a stripper. Then, scrape off the paint carefully. Follow the right techniques to avoid wood damage.

How do I use chemical strippers effectively?

Chemical stripping works well but needs the right approach. Choose the right stripper, apply it correctly, and clean and neutralize the surface afterwards.

What are the best heat-based paint removal approaches?

Heat methods like heat guns or open flames can work. But, they need caution and the right techniques to avoid wood damage.

How can I use mechanical paint removal techniques safely and effectively?

Sanding and scraping are effective but need the right tools and techniques. Use these methods carefully to avoid damaging the wood grain.

What are some eco-friendly paint removal solutions?

Eco-friendly solutions include natural methods and non-toxic alternatives. They are safe and effective for removing paint without harsh chemicals.

How can I deal with stubborn paint and special situations?

Dealing with tough paint and special situations requires specific techniques and tools. A heat gun or special chemical stripper can help.

How can I preserve the quality of the wood during paint removal?

Keeping the wood quality during removal is vital. Protect the wood grain and avoid common damage to ensure the surface remains intact.

What post-removal wood treatment and care is necessary?

After removal, treating and caring for the wood is essential. Apply a wood finish and protect it from damage to keep it healthy and intact.