To get out of a Bridgecrest loan, contact the lender and discuss a repayment plan or negotiate a settlement. Getting a loan can provide financial relief, but sometimes circumstances change and borrowers find themselves in a difficult situation.

Bridgecrest loans are no exception, and if you are struggling to meet the loan obligations, you may be looking for a way out. Whether it’s due to unforeseen events or a change in financial circumstances, there are options available to help you navigate through this situation.

This article will provide you with actionable steps on how to get out of a Bridgecrest loan by discussing repayment plans and negotiating settlements with the lender. By following these strategies, you can potentially alleviate your loan burden and regain control of your financial stability.

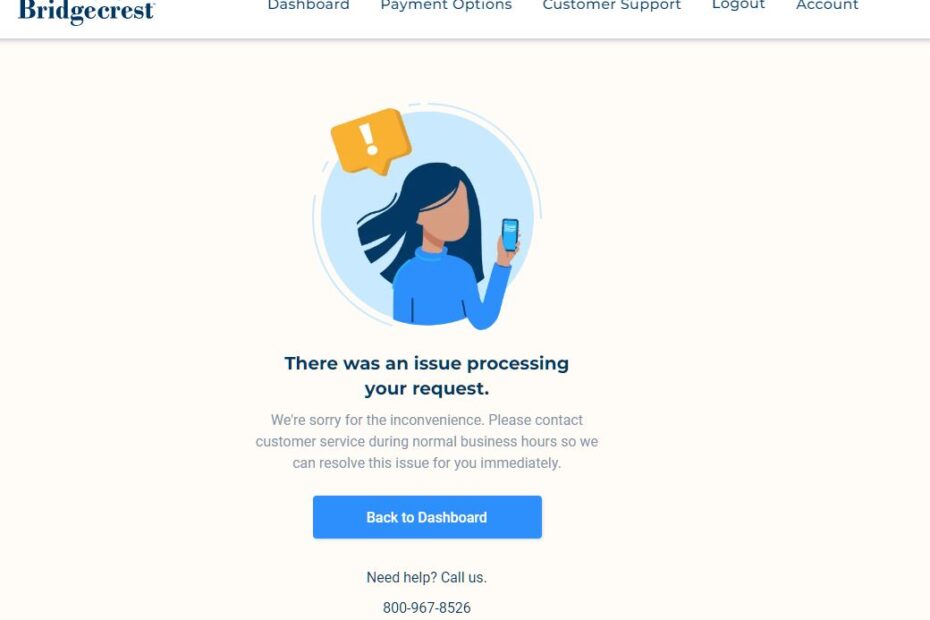

Credit: www.sitejabber.com

1. Evaluate Your Loan Terms

When it comes to dealing with a Bridgecrest loan, the first step you need to take is to evaluate your loan terms thoroughly. This will enable you to make informed decisions about how to proceed and find the best solution that suits your financial situation. Here are the key factors you need to consider during this evaluation process:

1.1. Review Your Loan Agreement

Start by carefully reviewing your loan agreement with Bridgecrest. Look for any important details or conditions that may have an impact on your ability to get out of the loan. Pay close attention to the repayment terms, including the length of the loan and any penalties for early repayment. Identify any clauses or provisions that may give you options for terminating the loan.

1.2. Calculate The Total Cost Of The Loan

Next, calculate the total cost of the loan. This involves adding up all the payments you have made so far, including any interest charges, late fees, or other applicable fees. By having a clear understanding of the total cost, you can determine if it is financially feasible for you to continue with the loan or if it would be more beneficial to explore other options.

1.3. Assess The Interest Rate And Fees

Another important aspect to consider is the interest rate and fees associated with your Bridgecrest loan. Take the time to assess whether the interest rate is reasonable and competitive compared to other lenders in the market. Also, be sure to identify any additional fees that may have been added to your loan, such as origination fees or insurance fees. Understanding these costs will help you determine the overall affordability and value of the loan.

Credit: www.sitejabber.com

2. Explore Refinancing Options

One way to escape the burden of a Bridgecrest loan is to explore refinancing options. Refinancing involves replacing your current loan with a new one from a different lender. This can potentially lead to lower interest rates, better terms, and potentially save you money in the long run. Let’s take a closer look at how you can go about refinancing your loan.

2.1. Research Other Lenders

To start the refinancing process, it’s crucial to research other lenders who offer competitive rates and loan terms. The market is full of lenders eager to assist you in refinancing your existing loan. Take the time to compare the options available and find a lender that suits your needs.

2.2. Compare Interest Rates And Terms

When exploring refinancing options, it’s important to compare interest rates and loan terms offered by different lenders. Look for lenders that offer lower interest rates than your current loan, as this can significantly reduce your monthly payments and save you money over time. Additionally, carefully examine the terms and conditions of different loans to ensure they align with your financial goals.

2.3. Determine If Refinancing Will Save You Money

Before proceeding with refinancing, determine whether it will truly save you money. Calculate the total cost of the new loan, including any additional fees or charges, and compare it to the remaining balance and interest of your Bridgecrest loan. Consider the length of the new loan and how much you’ll be paying in interest over time. By doing this analysis, you can make an informed decision about whether refinancing is the best option for you.

2.4. Apply For A New Loan

Now that you have done the research and determined that refinancing will save you money, it’s time to apply for a new loan. Contact the lender you’ve chosen and complete the application process. Be prepared to provide necessary documents such as proof of income, bank statements, and identification. Once your application is approved, you can use the funds to pay off your Bridgecrest loan and begin the new loan term with more favorable terms.

3. Consider Selling Or Trading In Your Vehicle

One option to get out of a Bridgecrest loan is to consider selling or trading in your vehicle. This can help you remove the burden of monthly loan payments and potentially get you into a more affordable or desirable vehicle. Before making a decision, there are a few important steps you should take to ensure you make the best choice for your situation.

3.1. Research The Market Value Of Your Vehicle

Before selling or trading in your vehicle, it’s essential to research its current market value. This will give you a realistic understanding of how much you can expect to receive for your vehicle. Online resources such as Kelley Blue Book or NADA Guides can provide an estimate based on factors like the make, model, year, mileage, and overall condition of your car. By having this information, you’ll be better equipped to negotiate and make informed decisions.

3.2. Calculate The Remaining Loan Balance

In order to determine the feasibility of selling or trading in your vehicle, you need to calculate the remaining loan balance. This is the amount you still owe on your Bridgecrest loan. Contact your lender to obtain the payoff amount, which may include any outstanding fees or interest. Subtract this amount from the estimated market value of your vehicle. If the market value is higher than the loan balance, this suggests that selling or trading in your vehicle could be a viable option.

3.3. Assess The Costs And Benefits Of Selling Or Trading In

Lastly, it’s crucial to assess both the costs and benefits of selling or trading in your vehicle. Consider the potential expenses associated with selling, such as advertising costs, registration fees for a new vehicle, or any necessary repairs or maintenance to make your car more appealing to buyers. On the other hand, weigh the benefits of getting out of a burdensome loan and potentially reducing your monthly expenses. Calculate the potential savings and compare it to the costs to determine if selling or trading in is financially advantageous for you.

Remember to carefully evaluate your current financial situation, future plans, and the condition and value of your vehicle before making any decisions regarding selling or trading in. By following these steps and being well-informed, you can make a decision that aligns with your needs and allows you to tackle your Bridgecrest loan effectively.

4. Negotiate With Bridgecrest

When faced with a Bridgecrest loan that is becoming overwhelming to manage, negotiating with the company can be a viable solution. This option allows you to work directly with Bridgecrest to find a mutually beneficial agreement that can help you get out of the loan effectively. Here are some steps you can take when negotiating with Bridgecrest:

4.1. Communicate With Bridgecrest

Open communication is essential when it comes to negotiating with Bridgecrest. Reach out to them and express your concerns about the loan. Clearly explain your current financial situation and discuss your inability to make timely payments. By keeping the lines of communication open, you can establish a dialogue which may lead to a more favorable resolution.

4.2. Request A Loan Modification

If you’re struggling to keep up with the loan payments, consider requesting a loan modification from Bridgecrest. This involves modifying the original terms of your loan agreement to make it more manageable for you. Explain the reasons for your financial hardship and propose alternative terms that better suit your current financial situation. Be prepared to provide supporting documentation such as income statements and budget plans to strengthen your case.

4.3. Explore Options For Loan Forgiveness

In certain circumstances, Bridgecrest may offer loan forgiveness programs that can help you eliminate a portion or all of your outstanding loan balance. Be sure to inquire about any loan forgiveness options available and understand the eligibility criteria for each program. If you meet the requirements, this could provide you with significant relief and a fresh start towards financial recovery.

4.4. Seek Legal Advice If Necessary

If negotiating directly with Bridgecrest doesn’t yield satisfactory results, it might be worthwhile to seek legal advice. Consulting with a professional who specializes in consumer law or debt relief can provide you with valuable insights and guidance. They can assess your specific situation, review your loan agreement, and advise you on the best course of action. Legal assistance can empower you to make informed decisions and protect your rights throughout the negotiation process.

Remember, negotiating with Bridgecrest requires patience and persistence. Be proactive, present your case clearly, and be willing to explore various options. With effective negotiation, you can pave the way towards resolving your Bridgecrest loan and regain control of your financial future.

5. Seek Financial Assistance

If you find yourself struggling to pay off your Bridgecrest loan, seeking financial assistance can be a great way to alleviate some of the burden. There are various resources available that can provide you with the support you need to overcome your financial challenges. In this section, we will explore different avenues of financial assistance to help you get out of your Bridgecrest loan.

5.1. Research Government Programs

Government programs can offer valuable assistance to individuals who are struggling financially. Take the time to research and explore the different programs that may be available to help you get out of your Bridgecrest loan. These programs can provide financial relief and help you manage your debt more effectively. Look for programs that offer loan forgiveness, debt consolidation, or income-based repayment options. Additionally, consider reaching out to government agencies and organizations that specialize in financial counseling and assistance.

5.2. Look For Local Resources And Grants

Local resources and grants can be a lifeline when facing financial difficulties. These resources are often tailored to the specific needs of your community and may provide financial aid, counseling services, or educational programs to help you overcome your financial challenges. Start by contacting local non-profit organizations, community centers, or religious institutions to inquire about any available resources or grants. Keep in mind that eligibility requirements may vary, so it’s essential to explore multiple avenues and see which options align with your specific situation.

5.3. Consider Non-profit Organizations

Non-profit organizations are dedicated to assisting individuals facing financial hardships. These organizations often offer various services, including financial counseling, debt management plans, or even direct financial aid. Research and reach out to non-profit organizations in your area that specialize in debt relief or financial assistance. They can provide you with expert advice and guidance on how to navigate your financial situation and potentially help you get out of your Bridgecrest loan.

Credit: www.linkedin.com

Frequently Asked Questions Of How To Get Out Of A Bridgecrest Loan

How Can I Get Out Of A Bridgecrest Loan?

To get out of a Bridgecrest loan, you have a few options. You can try to refinance the loan with another lender, negotiate a repayment plan with Bridgecrest, or sell the vehicle to pay off the loan. It’s important to communicate with Bridgecrest and explore your options to find the best solution for your situation.

Can I Cancel My Bridgecrest Loan?

Unfortunately, you cannot cancel a Bridgecrest loan once it has been approved and disbursed. However, you may have the option to refinance the loan with another lender or explore alternative repayment plans. It’s best to contact Bridgecrest directly to discuss your options and find a solution that works for you.

What Are The Consequences Of Defaulting On A Bridgecrest Loan?

Defaulting on a Bridgecrest loan can have serious consequences. It can negatively impact your credit score, leading to difficulty in obtaining future loans or credit. Bridgecrest may also repossess your vehicle as a result of default. It’s important to communicate with Bridgecrest if you’re having trouble making payments to explore alternative options and avoid default.

Can I Transfer My Bridgecrest Loan To Someone Else?

In most cases, Bridgecrest loans cannot be transferred to someone else. However, you may have the option to refinance the loan with another lender or explore alternative repayment plans. It’s best to contact Bridgecrest directly to discuss your options and find a solution that works for you and your specific situation.

Conclusion

Getting out of a Bridgecrest loan can be a daunting task, but with the right strategies, it is possible to regain financial control. By exploring options such as refinancing, negotiating with lenders, or even seeking the assistance of financial advisors, you can take the necessary steps to free yourself from the burden of a Bridgecrest loan.

Remember, staying proactive and persistent in your efforts will increase your chances of success. So, don’t hesitate to take action and start your journey toward loan freedom today.

- Geofencing for Enhanced Security: How It Can Optimize Trucking Operations - November 21, 2024

- The Power of Mobile Accessibility And Real-Time Tracking for Trucking Operations - November 6, 2024

- Why Ease of Use is Crucial in Trucking Dispatch Software - September 22, 2024